How and why to make a distinction between crypto coins and crypto tokens? It is a question increasingly addressed to legal advisers. The lawyers of TRINITI Finance, Intellectual Property and IT Law teams advise their customers namely in these areas.

Authors of this blog post are Katri Tomson, Karmen Turk and Maarja Pild

The issue under a dispute

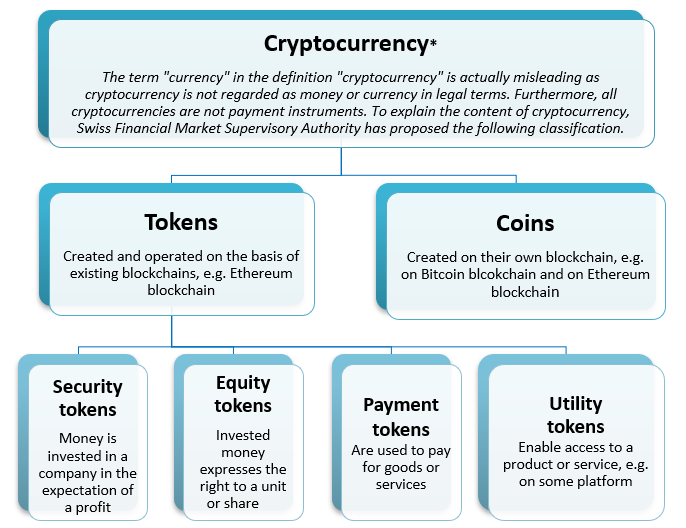

The more frequently the transactions with cryptocurrency (for the term “cryptocurrency” see table below) occur in commerce, the more natural it is that disputes shall arise.

However, in cryptocurrency disputes it is not possible to rely on long-term judicial practice and there are lot of nuances that require clarification.

It must be understood what is the issue under the dispute, before even answering the following questions:

- whether and how to file a claim against the other party to transfer cryptocurrency or tokens,

- whether interest on arrears can be demanded for delay,

- what are the bailiff’s tools regards enforcement of a court judgment made in a cryptocurrency dispute?

What does the term “cryptocurrency” mean?

Payment instrument or not

It is necessary to begin with the determination, whether cryptocurrency, that is the object of a transaction, is a payment instrument or not. As lawyers tend to answer – depends on the circumstances.

A traditional payment instrument is a means of payment which is valid, pursuant to law, in one or several countries (e.g. legal tender in Estonia and in the European Union is euro). In contrast, non-traditional (i.e. alternative) payment instruments are valid only if the transaction parties (a certain number of traders) accept them as an alternative to legal tender.

In addition, an alternative payment instrument must have a price expressed in traditional money at all times (exchange value) and it must be exchangeable against traditional money in the users’ environment.

Crypto coins are an alternative payment instruments, while crypto tokens are not. Confusion is often caused by the fact that the term – cryptocurrency – is commonly used both in the meaning of crypto coins and crypto tokens. Thus, it is important to make a difference between them, as legal remedies for protecting one’s rights are different in each case.

What kind of a cryptocurrency is it?

In choosing a suitable legal remedy, we suggest to follow the general division of cryptocurrency set out in the table below[1]:

Figuratively speaking, crypto coins are like a digital presentation of some specific value, which have not been issued by a central bank, credit institution or e-money institution having the right to do so, but which can be used as an alternative payment instrument in certain cases.[2] However, none of the tokens described in the table are considered as payment instruments.

Nevertheless, some tokens may be included in the scope of regulation of the Securities Market Act (for example security tokens).[3] At the same time, utility tokens are characterised exclusively by intra-organisational (e.g. platform-based) functionality and they do not have any status outside the certain institution (platform). They are rather comparable to bookshop gift cards or casino tokens, which are not compensated in money.

Selection of legal remedy depends on the nature of cryptocurrency

In order to choose proper legal remedy in case of a dispute over cryptocurrency, one should be able to make a distinction between coins and tokens. It is important to assess in every particular case what kind of claims the parties can file against each other.

If you want more information on this topic or a solution to a dispute which has occurred in your practice, the specialists of TRINITI Finance, Intellectual Property and IT Law are happy to help you!

[1] See e.g. Swiss Financial Market Supervisory Authority, ICO Guidelines, 2018.

[2] European Central Bank. Virtual currency schemes – a further analysis. 2015.